How to calculate cost of borrowing

The cost of any fees you might have to pay. Heres a simplified way of looking at it.

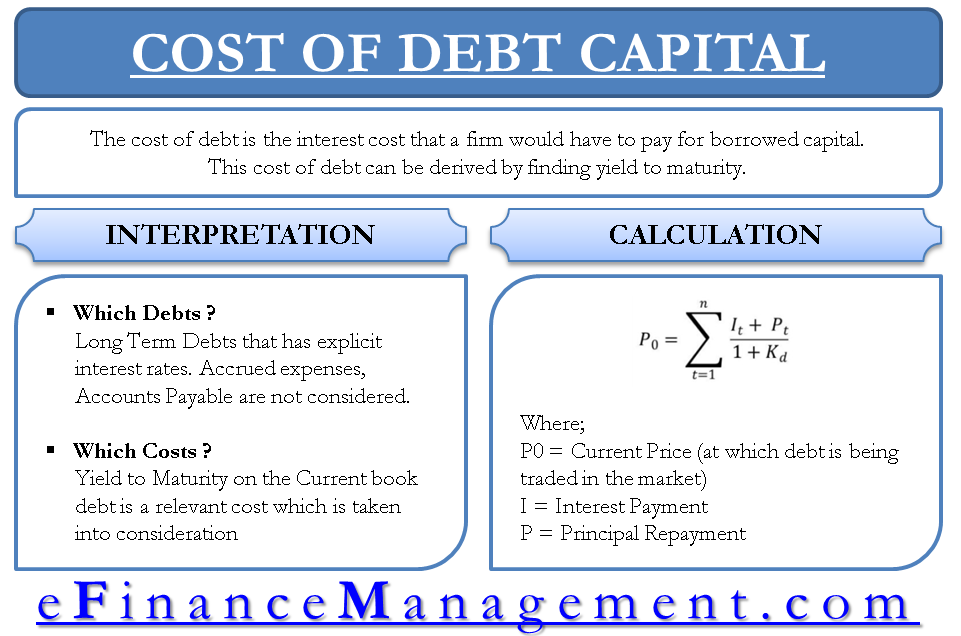

Cost Of Debt Kd Formula And Calculator Excel Template

Free loan calculator to find the repayment plan interest cost and amortization schedule of conventional amortized loans deferred.

. Tax laws in many countries allow deduction on account of interest expense. You might think at the end of the year you would have paid your friend back the loan plus 120 is interest 12 x 1000 120. What this means is that you will get charged 20 interest on your short position annually for being able to borrow the shares.

Enter the amount into the box. Usually borrowing costs are calculated in terms of Annual Percentage rate APR. Working out the true cost of borrowing means taking into account.

Deep Historical Options Data with complete OPRA Coverage. Eligible Borrowing Cost Actual Borrowing Cost Income from temporary investment of funds. Annual percentage rate or APR is the total cost of borrowing from a financial institution over one year.

Another big cost to consider. Now lets say youre a couple with one child with a. Use this calculator to find out how much a loan will really cost you.

Analytic and Tick Data. If you have outstanding payments on the principal of the loan at the end of each period meaning youve missed payments your interest will increase. Number of months to repay your loan.

To Use the online Loan Calculator 1 simply. Enter the amount into the box. Credit card Payoff Calculator.

As the loan is General loan so the Eligible Borrowing Cost will be calculated as follows. Subtract the total fees of 3500 from the principal and recalculate the annual Interest Rate as shown below. This will show you how the interest rate affects your borrowing or saving.

This will show you how the interest rate affects your borrowing or saving. The amount you want to borrow. Use the personal loan calculator to find out your monthly payment and total cost of borrowing.

Find out how much itll cost to borrow from your. After-tax cost of debt is the net cost of debt determined by adjusting the gross cost of debt for its tax benefits. Use the personal loan calculator to find out your monthly payment and total cost of borrowing.

Choose how much you want to save or borrow. Input the Annual interest rate for the loan. You can see that an ordinary amortization schedule.

40000 9 3125 Eligible Borrowing Cost 32875 W3. For a conventional loan your DTI ration cannot exceed 36. Interest rate An interest rate is a percentage charged on the total amount you borrow or save.

0005 x 20000 100. Usually interest rates for finance costs are not published by the Companies hence the investors use the following formula to calculate financing costs. Type into the personal loan calculator the Loan Amount you wish to borrow.

Possibility of no origination fee. To Use the online Loan Calculator 1 simply. The new AIR or the new EIR are often called the TOTAL COST of BORROWING or THE COST OF BORROWING.

Therefore this definition meets the explanation for those costs listed above. The interest cost over 25 years in 50053. Working out the true cost of borrowing means taking into account.

30 years Interest rate. The amount you want to borrow. Screenshot 3 The new EIR because of the total fees is 13670034 thus the TCOB is 1367 at two decimal places.

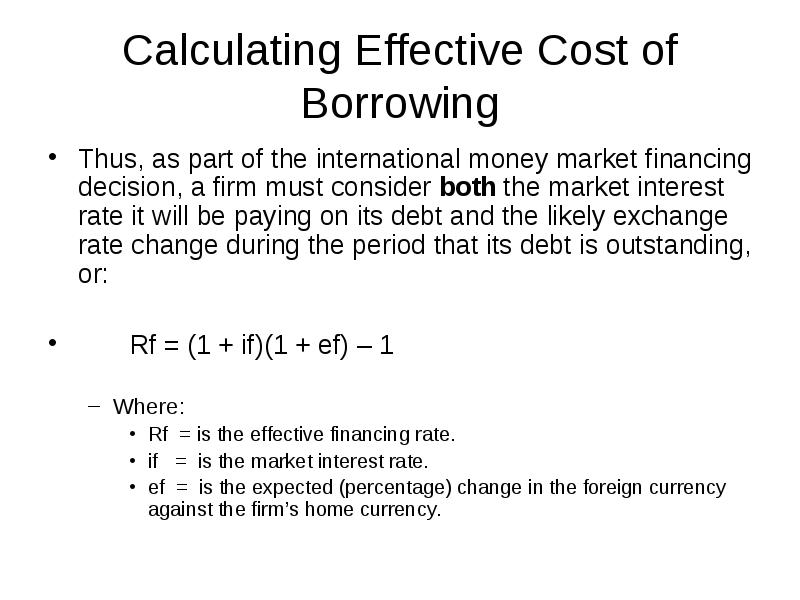

Cost of Borrowing Calculation. It equals pre-tax cost of debt multiplied by 1 tax rate. Select a province.

At interest rate. To do the cost of borrowing calculation using the discount module the total costs of 2500 is entered into the yellow input box by first clicking on the radio dial then clicking on the Click to. Taking an investment loan min.

Assume you borrowed 1000 for one year at 12 from a friend and agree to pay it back in 12 monthly payments of 8885. Eligible Borrowing Cost Average amount invested Weighted Average Into asset borrowing Cost Rate 49583 1372 Eligible Borrowing Cost 6545 W3 Average Amount Invested into Asset. The length of the borrowing term the time period youve agreed to repay what you borrow.

Principal Total Amount Borrowed Interest Fees APR Total Cost of Borrowing What this shows is theres more to loans than just interest rates. That 100 is how much youll pay in interest in the first month. IAS 23 states Borrowing costs are interest and other costs that an entity incurs in connection with the borrowing of funds.

To calculate your borrowing power we take into account a couple of key pieces of information your income and your debts. Total annual interest cost of the loan. Thus the borrowing costs will be calculated as follow.

Even a small change can have a big impact. For the figures above the loan payment formula would look like. The calculator is mainly intended for use by US.

For example if the lender assesses a fee of 5 and the loan amount is 250000 the fee will be 12500 and you will receive 237500. 006 divided by 12 0005. The rate of interest youll be charged.

The formula to calculate simple interest is. Calculate Your Rate in 2 Mins Online. The frequency of repayments for example weekly or monthly.

This will show you how the interest rate affects. It is the cost of debt that is included in calculation of weighted average cost of capital WACC. ROU stands for the right of use.

Ad Rich options pricing data and highest quality analytics for institutional use. Use this calculator to estimate interest deductions and cost of borrowing savings. The primary definition for borrowing costs comes from IAS Borrowing Costs.

This standard also dictates the accounting for those costs. Opens new window Select the term for your loan. Because this is a simple loan payment calculator we cover amortization behind.

Taking an investment loan min. If I had a short position of 50000 in XYZ my daily hard to borrow fee would be 50000 x 020 360 days 2778 day In some extreme instances HTB fees can be as high as 300. Use the slider to set the interest rate.

The interest cost over 25 years in 50053. W4 Weighted Average Borrowing Cost Rate. Your total minimum monthly debt is divided by your gross monthly income to express your Debt-to-Income ration DTI.

How To Get A Loan From A Bank

Excel Formula Calculate Payment For A Loan Exceljet

Accounting For Borrowing Costs Overview And Example Accounting Hub

Borrowing Base What It Is How To Calculate It

Understand The Total Cost Of Borrowing Wells Fargo

Degree Of Total Leverage Meaning Calculation Importance And More Financial Ratio Learn Accounting Financial Management

Pin On Go Math 16 1 Grade 8 Answer Key

Cost Of Debt Should Be Interest Cost On Capital Yield To Maturity Efm

Cost Of Debt Kd Formula And Calculator Excel Template

College Cost Calculator The College Board College Costs College Board Cost

Chapter 15 Mortgage Calculations And Decisions Ppt Video Online Download

Journey To Becoming A Chartered Accountant Calculation Of Borrowing Cost

International Finance Chapter 18 Addendum Financing And Investing Short Term

Free Cash Flow To Equity Fcfe Formula And Calculator Excel Template

Difference Between Lease And Finance Economics Lessons Accounting Basics Finance

Interest Rate Vs Annual Percentage Rate Top 5 Differences Interest Rates Percentage Rate

Efinancemanagement Financial Life Hacks Finance Accounting And Finance